Risk Profile Improvement Program Results

Discover how our Risk Profile Improvement Program has slashed over $60 million in premiums since 2004. Our team of risk managers, safety experts, and HR specialists work as an extension of your staff, implementing proven strategies like our Zero Culture - Behavior Based Safety program.

Statistical Results of the Duncan Risk Profile Improvement Program

Over $60 Million in Premium Savings Since 2004

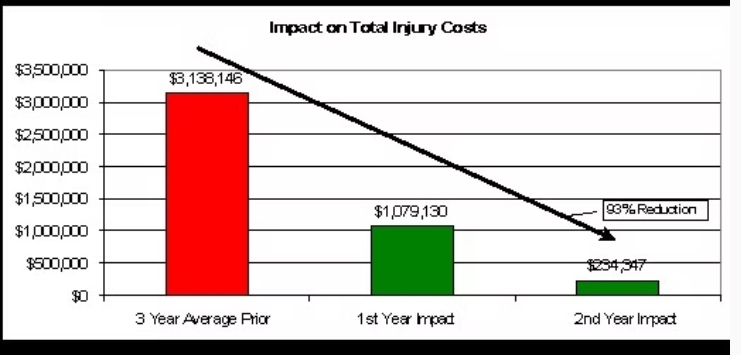

We have a significant number of clients that leverage our complete team of risk managers, health and safety professionals, human resources, and lost time and medical management specialists. These businesses have embraced our Risk Profile Improvement Program including our Zero Culture - Behavior Based Safety program. In essence, our team is "on staff but not on the payroll" of our clients. For those that have been involved in the Risk Profile Improvement Process for at least 2 complete years, we had an accounting firm compile the results below.

Our Risk Profile Improvement Program has lead to us slashing premium by over $60,000,000 since 2004!:

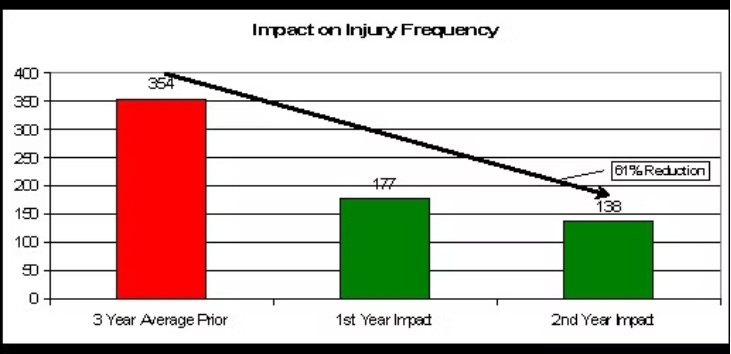

61% Reduction in the Number of Employee Injuries

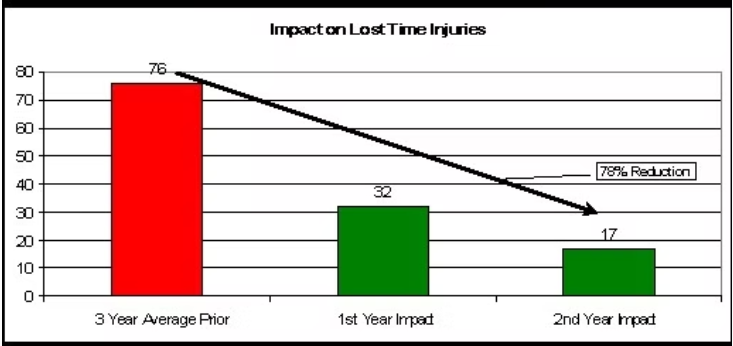

78% Reduction in the Number of Lost Time Injuries

93% Reduction in Total Injury Costs

Disaster Survivors

Companies that not only Survived, but Thrived!

From Ashes to Triumph: How the Right Insurance Choice Saved CCF Industries

On a peaceful Florida morning in April 2014, Ken Clifton's vacation was shattered by a call that would change everything - his business was engulfed in flames. As the owner of CCF Industries watched his livelihood burn from afar, he realized the true value of a decision he'd made not long before. Switching to David Leng and Duncan's insurance program had seemed intriguing at the time, but now it proved to be the lifeline that would save his company, providing over $3 million more in coverage than his previous policy and allowing Ken to rebuild, retain his employees, and ultimately lead CCF Industries to new heights of success.

Rethinking Risk: The Duncan Approach That Secured My Company's Future

I am so glad I met with David Leng and the team of professionals at the Duncan Financial Group.

I used to be the type of person that would get quotes on my insurance every two or three years. Dozens of agents would call me every year, three for four months prior to my renewal, and say they could save me money... get me the same coverage for less, and maybe they would point out holes or gaps in my coverage. When I look back at my old insurance policies, I now realize that if it were up to typical agents and the terrible, traditional quoting process... I would be out of business today.

They came in seven months prior to my renewal and took the time to meet with me and my staff, understand my business, and identify the risks I had in my operation.

They put together a Risk Improvement Plan to address our issues. They also overhauled our insurance program to a point where it looked nothing like my old policies, and they reduced my insurance costs as well.

The outcome was beyond belief. Because of Duncan's efforts, which goes well beyond quoting your insurance, not one of my employees or myself missed a paycheck. My business, in its beautiful new facility, is thriving and I am now able to hand this company over to my daughter and eventually my grandson.

-

Jack Kirsopp - Owner, Kirsopp Auto Body

Case Studies

Read our case studies to see how businesses across diverse industries have transformed their insurance costs and safety records. From automobile dealerships slashing premiums by over $1,000,000 to home health care companies reducing premiums by 59%, these real-world examples showcase the powerful impact of implementing comprehensive insurance and safety programs, resulting in dramatic cost savings and improved workplace safety.

Don't Just Take Our Word for It! Real Businesses, Real Results

Get Your Custom Risk Management Plan Today

Simply fill out the form and our team of experts will reach out to you to discuss your personalized risk management strategy.